Career Path - Tax Consultant

You’ll learn about financial community, Tax accountants, tax analyst, tax advisor, income tax consultant, tax recruiter etc.Preview Career Path - Tax Consultant course

Price Match Guarantee Full Lifetime Access Access on any Device Technical Support Secure Checkout Course Completion Certificate 80% Started a new career

BUY THIS COURSE (

80% Started a new career

BUY THIS COURSE (GBP 32 GBP 99 )-

88% Got a pay increase and promotion

88% Got a pay increase and promotion

Students also bought -

-

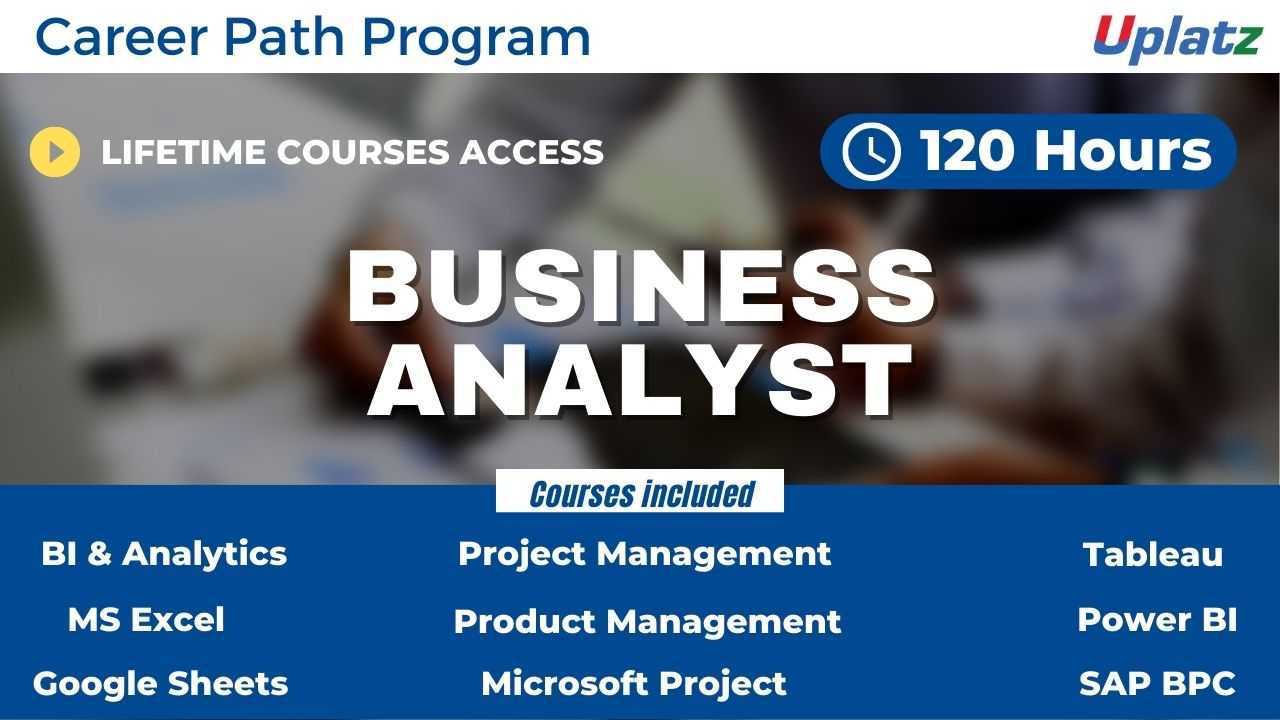

- Career Path - Business Analyst

- 120 Hours

- GBP 32

- 612 Learners

-

- Career Path - IT Consultant

- 200 Hours

- GBP 32

- 5851 Learners

-

- Career Path - Full Stack Web Developer

- 160 Hours

- GBP 32

- 2236 Learners

Embark on our Career Path - Tax Consultant program, featuring two core courses:

1. GST (Goods and Services Tax)

2. TDS (Tax Deducted at Source)

Taxation is basically a process of imposing tax on individuals who produce taxable income. A tax consultant/advisor is referred to as a tax accountant who helps people and organizations to complete their tax returns every financial year. This can involve extracting and analyzing information from their financial documents, like, wage, employment and mortgage, investment statements, etc. A tax consultant is also required to travel to meet with clients. Tax advisors can either work independently, for the government or for a firm. Their salaries also depend on the education qualifications.

The primary role of a tax consultant or a tax advisor is to help people and organizations in paying their taxes. They hold expertise in tax law, tax compliance, and tax planning. Both individuals and business owners can hire a tax consultant for long and short-term tax optimization.

Tax accountants play an important role in the financial community, particularly for business owners. Tax accountants prepare tax returns for individuals or organizations. Taxation is an exciting and demanding area of accounting consisting enormous scope and considerable future. Being well-versed in taxation can open numerous job opportunities for you as revenue managers, tax accountant, tax analyst, tax advisor, income tax consultant, tax recruiter, tax examiners, business tax consultant, property tax consultants, tax manager and collectors.

What must a tax consultant be able to do?

• Mathematical knowledge.

• Legal knowledge.

• Comprehensible communication of complex facts.

• Reliability and a sense of responsibility.

• Accounting skills.

After successful completion of Career path – Tax Consultant course, candidates can get various opportunities of work in both the private and public sector such as banking, stock market, and MNCs. In most of the cases, candidates are required to either complete an undergraduate or a PG diploma for better job opportunities. However, the average salary after completing a diploma in taxation is around Rs. 2.4 Lakh per annum.

Course/Topic 1 - GST - all lectures

-

1 - Introduction to GST in India - part 1

-

2 - Introduction to GST in India - part 2

-

3 - Introduction to GST in India - part 3

-

4 - Supply under GST - Intro and Definition - part 1

-

5 - Supply under GST - part 2

-

6 - Supply under GST - part 3

-

7 - Supply under GST - part 4

-

8 - Supply under GST - part 5

-

9 - Charge of GST - part 1

-

10 - Charge of GST - part 2

-

11 - Charge of GST - part 3

-

12 - Charge of GST - part 4.1

-

13 - Charge of GST - part 4.2

-

14 - Charge of GST - part 5

-

15 - Exemptions from GST - part 1.1

-

16 - Exemptions from GST - part 1.2

-

17 - Exemptions from GST - part 2.1

-

18 - Exemptions from GST - part 2.2

-

19 - Exemptions from GST - part 3

-

20 - Exemptions from GST - part 4

-

21 - Exemptions from GST - part 5

-

22 - Exemptions from GST - part 6

-

23 - Place of Supply - Intro & Definition

-

24 - Place of Supply - Sections 10 & 11

-

25 - Place of Supply - Section 12 - part 1

-

26 - Place of Supply - Section 12 - part 2

-

27 - Place of Supply - Section 13

-

28 - Time of Supply - Intro & Definition

-

29 - Time of Supply - Section 12

-

30 - Time of Supply - Section 13

-

31 - Time of Supply - Section 14

-

32 - Value of Supply - Intro & Definition

-

33 - Provisions for Valuation of Supply

-

34 - Rules for Valuation of Supply - part 1

-

35 - Rules for Valuation of Supply - part 2

-

36 - Input Tax Credit - Intro & Definition

-

37 - Apportionment of Blocked Credits

-

38 - Blocked Credit in Special Circumstances - Section 18

-

39 - Blocked Credits - part 1

-

40 - Blocked Credits - part 2

-

41 - Distribution of Credit by ISD - Sections 20 & 21

-

42 - Input Tax Credit - Section 16

-

43 - Registration - Intro & Definition

-

44 - Registration - Section 22

-

45 - Registration - Sections 23 & 24

-

46 - Registration - Section 25 - part 1

-

47 - Registration - Section 25 - part 2

-

48 - Registration - Sections 26 to 30 and Rules

-

49 - Tax Invoice - Definition & Section 31

-

50 - eInvoicing

-

51 - Tax Invoice - Special Cases - part 1

-

52 - Tax Invoice - Special Cases - part 2

-

53 - Credit and Debit Notes

-

54 - Accounts and Records - part 1

-

55 - Accounts and Records - part 2

-

56 - Electronic Way Bill - part 1

-

57 - Electronic Way Bill - part 2.1

-

58 - Electronic Way Bill - part 2.2

-

59 - Electronic Way Bill - part 3

-

60 - Payment of Tax - Intro & Definition

-

61 - Payment of Tax - Section 49

-

62 - Payment of Tax - Section 50

-

63 - Returns - Intro & Definition - part 1

-

64 - Returns - part 2

-

65 - Returns - part 3

-

66 - Returns - part 4

-

67 - Returns - part 5

-

68 - Import and Export under GST - Intro & Definition

-

69 - Import of Goods under GST

-

70 - Import of Services under GST

-

71 - Registration and ITC in case of Import of Goods and Services

-

72 - Export under GST

-

73 - Refunds - part 1

-

74 - Refunds - part 2.1

-

75 - Refunds - part 2.2

-

76 - Refunds - part 3

-

77 - Refunds - part 4

-

78 - Refunds - part 5.1

-

79 - Refunds - part 5.2

-

80 - Job Work - part 1

-

81 - Job Work - part 2

-

82 - Assessment and Audit - part 1

-

83 - Assessment and Audit - part 2

-

84 - Inspection - Search - Seizure - Arrest - part 1

-

85 - Inspection - Search - Seizure - Arrest - part 2

-

86 - Demands and Recovery - Intro & Definition

-

87 - Demands and Recovery - Sections 73 & 74

-

88 - Demands and Recovery - Section 75

-

89 - Demands and Recovery - Sections 76 & 77

-

90 - Demands and Recovery - Sections 78 to 84

-

91 - Liability to Pay in Certain Cases

-

92 - Offences and Penalties - Intro & Definition - Sections 122 & 123

-

93 - Offences and Penalties - Sections 124 & 130

-

94 - Offences and Penalties - Sections 131 & 138 and Rules

-

95 - Advance Ruling

-

96 - Appeals and Revision - part 1

-

97 - Appeals and Revision - part 2

-

98 - Appeals and Revision - part 3

-

99 - Appeals and Revision - part 4

-

100 - TDS (Tax Deduction at Source) and TCS (Tax Collection at Source)

-

101 - Miscellaneous Provisions - part 1

-

102 - Miscellaneous Provisions - part 2

-

103 - Miscellaneous Provisions - part 3

-

104 - Miscellaneous Provisions - part 4

Course/Topic 2 - TDS - all lectures

-

In this session we will learn about the introductory topics of TDS like What is TDS, by whom TDS is collected and how it is controlled by the Central Board of Direct Tax (CBDT). Further we will also highlight some of the important section of TDS.

-

In this session we will learn cover Section 192, 192A,193 of TDS. This video talks about the various sources of income, applicability of TDS, rate of TDS and Time of deduction of TDS. Further we will see withdrawal from Employee Provident Fund and TDS on premature withdrawal of EPF. Lastly we will study about the interest on securities.

-

In this tutorial we will cover the Section 194, 194A of TDS. This video talks about the TDS on Dividend, its applicability and rate of interest. Further we will learn about TDS on interest other than interest on securities.

-

In this tutorial you will learn about the Section 194B to Section 194H of TDS. This video talks about the winnings from lotteries, crossword puzzles and other games. Further we will see about the winnings from horse races and tax on payments to contractors and sub-contractors. Lastly we will learn about the TDS on commission or brokerage.

-

In this session we will cover about the Section 194I to section 194O of TDS. This video talks and explains about the TDS on rent and its applicability. Further we will see the TDS on payment on transfer of certain immovable property other than agricultural land. Lastly we will learn about the TDS on fees for professional or technical services.

-

In this session we will learn about the payment of TDS and due date of payment of TDS. Further we will see how payment is paid through challan and interest on non-payment or late payment of TDS.

-

This video covers the topic of TDS returns and return filling due dates. This session talks about the eligibility criteria of TDS return and due dates of TDS return. Further we will see about the TDS return forms and their types. Lastly we will see how to download and fill TDS return forms.

•Learn about comprehensible communication of complex facts.

•Learn about accounting skills.

•Get legal knowledge

•Learn about tax recruiter, tax examiners, business tax consultant, property tax consultants, tax manager and collectors.

TheTax ConsultantCertification ensures you know planning, production and measurement techniques needed to stand out from the competition.

The primary role of a tax consultant or a tax advisor is to help people and organizations in paying their taxes. They hold expertise in tax law, tax compliance, and tax planning. Both individuals and business owners can hire a tax consultant for long and short-term tax optimization.

There are no prescribed qualifications to become a tax consultant/ advisor. Individuals with interpretation skills and expertise in Tax Laws can act as a Tax Consultant. Tax Laws are changing all the time so they should be up-to-date with recent Circulars, Notifications, Rules, etc.

A tax consultant has to undergo extensive taxation training before becoming a professional tax consultant but there are certain fundamentals that make them eligible to take the courses in taxation. These basics can be the knowledge of taxation, inclination towards the subject and the existing qualification.

Uplatz online training guarantees the participants to successfully go through the Tax Consultant Certification provided by Uplatz. Uplatz provides appropriate teaching and expertise training to equip the participants for implementing the learnt concepts in an organization.

Course Completion Certificate will be awarded by Uplatz upon successful completion of the Tax Consultant online course.

The Tax Consultant draws an average salary of $120.000 per year depending on their knowledge and hands-on experience.

Tax advisors can either work independently, for the government or for a firm. A tax consultant has to undergo extensive taxation training before becoming a professional tax. A tax consultant/advisor is referred to as a tax accountant who helps people and organizations to complete their tax returns every financial year.

Tax advisors can either work independently, for the government or for a firm.

A tax consultant has to undergo extensive taxation training before becoming a professional tax. A tax consultant/advisor is referred to as a tax accountant who helps people and organizations to complete their tax returns every financial year.

Note that salaries are generally higher at large companies rather than small ones. Your salary will also differ based on the market you work in.

Tax Consultant.

Technology Advisory.

Question 1. What Is Venture Capital?

Answer :

Venture capital (VC) is money provided to seed early-level, emerging and emerging growth agencies. Venture capital budget invest in corporations in alternate for fairness within the companies they invest in, which generally have a unique era or commercial enterprise version in high generation industries, consisting of biotechnology and IT.

Question 2. What Would You Do If You Had 50 Xyz To Be Delivered Within 2 Days And You Feel You Wouldn't Be Able To Do It?

Answer :

I would be sensible about it and inform my manager that 50 is not feasible within this time frame. Suggest him an opportunity path of motion to be taken for this.

Question 3. Why Mba In Finance After Completing Engineering?

Answer :

It may be useful for us if we need to head in industrial career.

Question 4. Why Do You Want To Take Up A Career In Us Taxation?

Answer :

It could permit me to explore some thing unique as well as now not absolutely alienate me from my location of specialization.

Question 5. Describe A Situation When You Demonstrated Working In A E Group?

Answer :

I pointed out an example where one in all my group member's calculations had been glaringly incorrect. Nobody else inside the organization become going to mention anything or question this member's paintings. The organization member appeared very assured about his calculations. In a well mannered manner, I spoke up and initiated a dialogue with the institution member. He started explaining his calculations and my responses have been along the lines of, "My expertise of a way to calculate this ratio is...Permit's appearance it up just to make sure." After some dialogue, he realized that he had made a few errors in his calculations. I confirmed leadership by starting up a tough communique, which added about a higher result for the entire institution.

Question 6. During My First Interview, The Director Asked Me: If You Were About To Catch A Flight To Meet With Your Most Important Client, And Only Had Five Minutes Till You Board, What Two Publications Would You Buy?

Answer :

The Wall Street Journal, and New York Times. He spoke back with, extremely good choices.

Question 7. Why Do You Want To Work In Tax?

Answer :

I mentioned my instructional records which confirmed an interest in tax.

Question 8. What Will You Do If A Team Member Isn't Working Properly?

Answer :

Will try to motivate him

Discuss in my opinion what are the elements influencing him.

If he isn't always improved, no choice. Will ship him lower back.

Question 9. Why Should I Hire You Instead Of An Llm Graduate? Why Should I Sponsor You A Visa?

Answer :

I actually have Asia tax enjoy whilst regulation college grads do not have this sort of business attitude - it truly is how I can add fee to your exercise.

Question 10. Tell Me About A Time That Your Supervisor Gave You A Constructive Suggestion, And How Did You Take It?

Answer :

During interviews you've got to participate in all one-of-a-kind kinds of networking events. Maintaining energetic, excited and focused the whole time is the most difficult element.