Bundle Ultimate - SAP Finance and SAP TRM (FICO - BPC - TRM - S/4HANA Finance - S/4HANA TRM)

You will learn all financial and operational data and deliver a flexible as well as easily consumable reporting.Preview Bundle Ultimate - SAP Finance and SAP TRM (FICO - BPC - TRM - S/4HANA Finance - S/4HANA TRM) course

View Course Curriculum Price Match Guarantee Full Lifetime Access Access on any Device Technical Support Secure Checkout Course Completion Certificate 86% Started a new career

BUY THIS COURSE (

86% Started a new career

BUY THIS COURSE (USD 31 USD 69 )-

90% Got a pay increase and promotion

90% Got a pay increase and promotion

Students also bought -

-

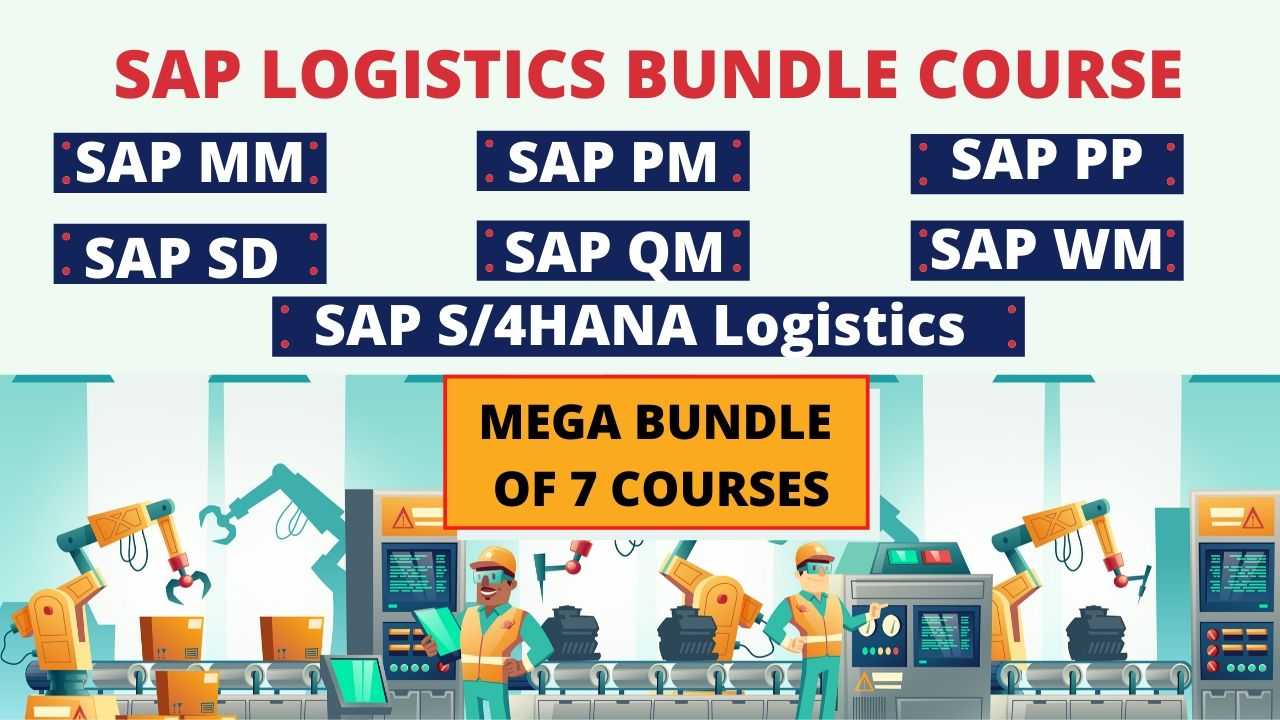

- Bundle Course - SAP Logistics (PM - PP - MM - QM - WM - SD - S4HANA Logistics)

- 200 Hours

- USD 31

- 1692 Learners

-

- Bundle Multi (3-in-1) - SAP FICO

- 90 Hours

- USD 31

- 502 Learners

-

- Bundle Combo - SAP TRM (ECC and S/4HANA)

- 35 Hours

- USD 31

- 1618 Learners

The SAP Bundle Ultimate - SAP Finance and SAP TRM is a bundle course by Uplatz consisting of self-paced training (pre-recorded videos) on the following SAP modules:

1) SAP S/4HANA Finance

2) SAP S/4HANA TRM

3) SAP FICO

4) SAP BPC

5) SAP TRM

1.SAP S/4HANA Finance is a comprehensive set of financial management and accounting solutions, covering financial planning and analysis, accounting and financial close, treasury and financial risk management, collaborative finance operations, and enterprise risk and compliance management powered by the SAP HANA in-memory database. SAP S/4HANA is the next generation business suite from SAP fully integrated with most advanced in-memory platform, SAP HANA. Using SAP S/4HANA Finance, user can create a common view of all financial and operational data and deliver a flexible as well as easily consumable reporting.

2.SAP S/4HANA TRM (Treasury and Risk Management) module is a series of solutions geared towards analysing and optimizing business processes in the finance area of a company. This SAP S/4HANA TRM training and certification course by Uplatz introduces you to the Treasury and Risk Management functionality in SAP S/4HANA including the steps, products and functions related to the Debt and Investment Management Process and the FX Risk Management Process.

3.SAP Finance and Controlling (FICO) is a core module in SAP ERP where FI stands for Financial Accounting and CO stands for Controlling. SAP FICO module is very robust and covers all financial processes followed in diverse industries. SAP FICO system enables you to centrally track financial accounting data within an international framework of multiple companies, languages, currencies, and charts of accounts. SAP FICO module mainly deals with essential elements such as fixed assets, accrual, bank, cash journal, inventory, tax accounting, general ledger, accounts receivable, accounts payable, fast close functions, financial statements, parallel valuations, master data governance, and the like.

4.SAP Business Planning and Consolidation (BPC) is an important SAP module that helps an organization to run a business successfully through strategic planning, budgeting, reporting, and forecasting. SAP BPC provides a single view of financial & operational data and acts as a unified solution which supports performance management processes. SAP BPC module forms the basis for legal and management consolidations by providing a highly scalable, robust database combined with business process and logic capabilities to form a true Enterprise Performance Management (EPM) platform. SAP BPC is an integrated solution for an organization that meets their bottom-up and top-down financial and operational planning requirements coupled with forecasting and reporting capabilities.

5.SAP Treasury and Risk Management (TRM) is one of the key components in the SAP ECC platform. It is referred to as the management of an enterprise’s holdings, cash and working capital with the ultimate goal of managing the firm’s liquidity and mitigating its financial and reputational risk. SAP TRM in ECC is an integrated solution in which the various components are closely linked. It includes the management of an enterprise, holdings, cash, and working capital. With the ultimate goal of managing the firm’s liquidity and mitigating it is operational financial and reputational.

Uplatz provides this extensive training on SAP Finance and TRM functions covering all relevant modules in a bundle course, along with course completion certificate.

Course/Topic 1 - SAP S/4HANA Finance - all lectures

-

In this first video on the SAP S/4HANA Finance course, you will be getting a detailed explanation of the Costing-based CO-PA and Account-based PA along with the derivative of characteristics which will be shown in the SAP system by the trainer. Furthermore, you will be learning about the COGS G/L Accounts.

-

In this video, you will get a brief introduction to S/4HANA Finance module, starting with the release versions of S/4HANA, its advantages, the database, and table structure, the use of Fiori in S/4HANA which will be shown in the SAP system, and the transition scenarios to S4.

-

In this session, you will learn about the idea and concept of Universal Journal along with the differences between BSEG and ACDOCA. Furthermore, you will learn about the Non-Disruptive approach, the purpose and advantages of Extension Ledger, merging of GL & Cost element master data, the currency configuration, and the steps involved in the configuration of CO Integration.

-

In this video, you will learn all the configuration settings involved with GL account in S/4HANA Finance which will be shown in a step-by-step process by the trainer in the SAP system.

-

This is a continuation video to the previous lecture where you will get some more in-depth and detailed concepts associated with the GL accounts in the S/4HANA Simple Finance module.

-

In this video, you will learn about the complete work process of Ledger for the HANA Simple Finance module and its step-by-step process in the SAP system.

-

In this video, the trainer will be going through the different apps associated with the General Ledger Accounting, and along with this, the session will also be moving further with the concepts on BP.

-

In this video, you will be going through the work process of Cash Journal Entry and Master Data Maintenance in the SAP system. Furthermore, you will be learning about the BP groupings in the S/4HANA Finance module.

-

In this session, you will learn about the concepts related to Bank Accounting Management or commonly abbreviated as BAM. During this session, you will be learning about the Bank Hierarchy, Overdraft Limits, BCM, Centralized BAM, Liquidity Management, and Cash Operations.

-

In this video, you will get a brief overview of the architecture of New Asset Accounting, the pre-requisites for New Asset Accounting, Migration, Legacy Data Transfer, the limitations associated with Asset Accounting, and others.

-

In this video, you will learn about the changes associated with Asset Accounting from a user along with the concept of Depreciation Run in the S/4HANA Finance module.

-

In this video, you will learn about the different configuration steps associated with the Migration process of the S/4HANA Finance module. The trainer will be showing a step-by-step process of the whole work procedure in the SAP system.

-

In this video, you will know and learn about the different prerequisites for the New Asset Accounting and working on the same in the SAP system.

-

In this video, you will be going through the taxation part of the SAP S/4HANA Finance module and its work process in the SAP system.

-

In this video, the trainer will be seen answering some of the queries associated with the S/4HANA Finance course along with explaining the solutions in regard to resolving the queries.

-

In this video, you will get a brief knowledge on Profitability Analysis starting with an overview on Costing-based CO-PA, Account-based CO-PA, the Profitability Analysis in the Universal Journal, COGS concept and other detailed concepts associated with it.

-

In this last video on the SAP S/4HANA Finance course, you will learn about the different steps associated with Migration in S/4HANA Simple Finance such as Migration of Customizing, Data Migration, and Activities after Migration and all these steps will be shown with a detailed explanation by the trainer in the SAP system.

Course/Topic 2 - SAP FICO course - all lectures

-

Demo Session - Accounts Payable

-

PART 1 - Enterprise Structure

-

PART 2 - ES2 FYV PPV FSV

-

PART 3 - DT COA TG GL

-

PART 4 - GL POSTING

-

PART 5 - TOOLS FOR END USER

-

PART 6 - MONTH END PR OPEN ITEM

-

PART 7 - ACCRUAL INT CAL

-

PART 8 - AP 1

-

PART 9 - ADV DISCOUNT

-

PART 10 - AP CHECK MGT

-

PART 11 - AR

-

PART 12 - T O P DUNN

-

PART 13 - DUNN2 B O E

-

PART 14 - CJ2 AA1

-

PART 15 - AA2

-

PART 16 - AA3

-

In this first video tutorial, you will get a brief introduction on Controlling and the different concepts related to CO such as what is a Cost Center Standard Hierarchy, how to create the Controlling Area in CO and also what is FI and why is it necessary to assign company code through FI. Further, you will get a practical demonstration by the instructor on the basics of working with new entries in the SAP CO system.

-

In this tutorial, you will learn and understand an overview of Cost Elements, what are the different types of Cost Elements which are basically Primary Cost Element and Secondary Cost Element. You will also learn how you can create a Primary Cost Element, Cost Centers and Cost Center Groups. Moreover, you will also understand the concept of CO document, working with maintaining number ranges groups, maintaining versions and the difference between the Plan and Actual Data Variance. All theses will be taught with practical demonstration in the SAP CO system by the instructor.

-

In this video, you will learn the different concepts related to the Internal Order in the SAP CO module such as its different types, what is a Statistical Order and Real Order, how to work on these two in the CO system, creation of Order Types and also creating Internal Order in the system. Further, you will also learn about the maintenance of Allocation Structure in the SAP CO system.

-

This is a complete practical demonstration video on the creation of Order Type along with creating Internal Orders in the SAP CO system. Further, you will understand how to work on the CO documents with Profit Center Accounting and an overview and practical demonstration of creating Account Groups in the SAP CO system.

-

In this last tutorial, you will learn to link the different G/L accounts with the Profit Centers in the SAP CO system. Along with this, you will also learn about the posting of transactions such as Revenue Posting and Expenses, FI-MM integration, what are the activities to be performed as an MM consultant in the FI-MM integration process and what are the prerequisites needed for the integration. All these steps will be succeeded with a detailed demonstration by the instructor in the SAP CO module system.

-

PART 22 - FI MM2

-

PART 23 - FI MM3

-

PART 24 - FI MM4

-

PART 25 - FIMM 5 FI SD1

-

PART 26 - FISD2

-

PART 27 - FISD3

-

PART 28 - FSV TB

-

PART 29 - YEAR END ACTIVITIES

-

PART 30 - NEW GL ASAP

Course/Topic 3 - SAP BPC course - all lectures

-

In this lecture session of BPC Terminology and the Objects we learn about technologies of BPC.

-

In this lecture session we talk about Bi Terminology and Data flow, a basic example of Data flow.

-

In this lecture session we learn about presentation layer, application layer and database layer and also talk about standard Environment.

-

In this lecture session we learn about Audit functionality and also talk about different types of audit functionality.

-

In this lecture we learn about balance carry forward and also cover business rules of BPC.

-

In this lecture session we learn about session number, report workbook and workbook description.

-

In this lecture session of BPC Security we learn about how to set up BPC security and also cover the importance of BPC security.

-

In this lecture session of BPC we learn about consolidation of investment. We also cover all functions of consolidation of investment.

-

In this session we learn about business planning and consolidation and different types of hierarchy.

-

In this session of SAP BPC we talk about proportional methods and also cover different types of methods of SAP.

-

In this lecture session we learn about SAP BPC copy and clear function we also talk about different types of functions in SAP BPC.

-

In this lecture session we learn about currency Translation and legal consolidation and also talk about the basic model of currency translation.

-

In this lecture session of SAP BPC we talk about legal consolidation and also talk about logic script of legal consolidation.

-

In this lecture session we give you an overview of EPM. What is EPM and how EPM works in SAP BPC.

-

In this session we learn about EPM functions and also cover different types of functions present in SAP EPM.

-

In this lecture session we learn about EPM user and EPM server and also cover all the techniques of EPM.

-

In this lecture session of SAP BPC we talk about Journal consolidation central and also cover functions of consolidation central.

-

In this lecture session we learn about logics. We also talk about member formulas and also cover all types of formulas that are present in logics.

-

In this lecture session we learn about Logics scripts. We also talk about parts of logics script and all properties of logics script.

-

In this lecture session we learn about member offset and also cover basic examples of member offset in EMP.

-

In this lecture session we learn about variables in logic script and also cover different types of variables in Logic script.

-

In this lecture session we talk about allocation and lookup and also talk about multi model scripting.

-

In this lecture session we learn about master data load and also cover if we load the master data from BI info object.

-

In this lecture session we learn how to create transformation files for field to field mapping and validation of conversion files.

-

In this lecture session we talk about master data load via Bi Info object and also cover all the techniques of master data load.

-

In this lecture session we learn how we submit the data by using an input form and also cover how the input form looks like.

-

In this lecture session we learn about transaction of data load from Bi infoprovider and logic script.

-

In this lecture session we talk about how to create a cash flow statement where the amount of several accounts is copied.

-

In this lecture session of SAP BPC we talk about how to create a report. We also cover different types of methods of creating reports.

-

In this lecture session we learn how to check the work status and we also cover the features of work status.

-

Once you finish your planning and consolidation the finalized data prevents any further changes. We also cover how to maintain work status.

Course/Topic 4 - SAP TRM - all lectures

-

In this lecture we learn about how much a basic data necessary to process cash management. How to create a company code and creation of a posting period variant.

-

In this lecture we discuss about the company code akus and why we need to know the customer requirements and configurations, and some basic about the manual memo records.

-

Some major examples of check received from the customer and deposit functions. how to create and assign the business transection.

-

In this lecture we talk about liquidity forecasting and features of the liquidity forecasting. Defining planning levels and how do you distinguish between various planning groups.

-

This session is all about the company code : AB00 and brief detail about manual memo records and configuration about liquidity forecasting. Defining the planning groups.

-

In this session we talk about manual bank statement, check deposit procedure and overview of cash concentration.

-

In this session we discuss about exercise on check deposit procedure and manual bank statement and a brief introduction of check deposit procedure.

-

This session is about Cash concertation. Cash consternation involve moving the balance different Bank account into one target accounts and basic objectives behind Cash consecration.

-

Creation of bank master record at the country level and creation of house bank in the company code. We also talk about the financial accounting.

-

In this lecture of (SAP TRM). We learn about financial supply chain management, strategy enterprise management and real Estate management.

-

In this lecture we discus about the concept called as limit management and trading areas. You will get all the information for the existing transection or make any adjustment to transections.

-

Transection manager is one of the most important components which support the management of all the financial transaction and the position.

-

In this lecture we learn about how much a basic data necessary to process cash management. How to create a company code and creation of a posting period variant.

-

In this lecture section 11.1 we talk about Business processes in treasury & risk management.

-

Lecture 11.2 - SAP TRM

-

Master Data configuration steps for processing the transaction manager easy access to create financial transaction. SAP business partners, business partners are divided into two categories.

-

SAP business partner and standing instruction. Exercise on creation of SAP business partners and how payment advice will help you in the manual bank statement.

-

In this lecture we discuss about the payment details contains needed information needed for processing the payment.

-

In this session we talk about the money market and business processes in treasury & risk management.

-

IN SAP TRM 15TH session we cover copying the default values when you are creation a financial transaction with the business partner and Derived flows.

-

In this session we talk about how we are maintaining the calendar and assigning the factory calendar per currency and defining the planning levels for SAP treasury.

-

Trademarks and configuration of money market. Types of products identified the types of products transaction types identifies the type of transaction that can be arising out of the product type.

-

In this session you define and create the transaction types and then assign to the product type each transaction type is identifies by a 3-digit number key.

-

In this session we talk about classification and structural characteristic to be used for an investment (decrease) or borrowing (increase).

-

Payment request for the outgoing payment or for the incoming payments FSCM. You can generate the payment request for the outgoing payment or for the incoming payments.

-

In this session we talk about configuration steps for the fixed deposit – 10 steps.

-

Accounting – FSCM -TRM Transaction manager - money market trading edits to financial transaction. Fsat data entry, create, change, display, rollover, reserve, history settlement give notice

-

In this session we talk about the creation of financial for fixed term deposits and 5 different financial transactions for fixed term deposit.

-

Derived flows using derivation product. In this last session we learn about creation of a fixed term deposit as investment.

In this course you will learn about;

1) Costing-based CO-PA and Account-based PA

2) Overview of S/4HANA Simple Finance

3) Universal Journal and Ledger

4) Working with Ledger

5) Apps for General Ledger Accounting

6) New Asset Accounting on S/4HANA

7) Changes in Asset Accounting

8) Prerequisites for New Asset Accounting

This comprehensive course covers SAP Finance (FICO), Business Planning and Consolidation (BPC), and Treasury and Risk Management (TRM) within the S/4HANA environment. Participants will gain in-depth knowledge of financial processes, budgeting, consolidation, and treasury management, preparing them for real-world applications and implementations.

Part 1: Introduction to SAP Finance (FICO)

Week 1: Overview of SAP Finance (FICO)

a).Introduction to SAP FICO: Objectives, components, and benefits

b).Overview of the financial accounting (FI) and controlling (CO) modules

c).Key integration points with other SAP modules

d).Hands-on exercise: Navigating the SAP FICO interface

Week 2: Financial Accounting (FI)

a).Understanding key FI functionalities: General Ledger, Accounts Payable, and Accounts Receivable

b).Configuring master data: Customers, vendors, and chart of accounts

c).Managing financial transactions and document types

d).Hands-on exercise: Processing financial documents in SAP FI

Week 3: Controlling (CO)

a).Overview of CO functionalities: Cost Centers, Profit Centers, and Internal Orders

b).Configuring cost elements and controlling settings

c).Reporting and analysis in CO

d).Hands-on exercise: Creating and managing cost center reports

Part 2: Business Planning and Consolidation (BPC)

Week 4: Introduction to SAP BPC

a).Overview of SAP BPC: Objectives and key features

b).Understanding the BPC data model and master data setup

c).Configuring planning processes and workflows

d).Hands-on exercise: Setting up a planning model in BPC

Week 5: Budgeting and Forecasting in BPC

a).Creating input templates for budgeting and forecasting

b).Implementing scenario planning and version management

c).Utilizing statistical methods in planning

d).Hands-on exercise: Developing budgeting templates in BPC

Week 6: Reporting and Consolidation in BPC

a).Overview of reporting tools: EPM Add-In and Analysis for Office

b).Configuring consolidation processes: Intercompany eliminations and adjustments

c).Best practices for reporting and analysis in BPC

d).Hands-on exercise: Building reports and dashboards in BPC

Part 3: Treasury and Risk Management (TRM)

Week 7: Introduction to SAP TRM

a).Overview of Treasury and Risk Management concepts

b).Understanding financial instruments and risk types

c).Configuring master data for treasury operations

d).Hands-on exercise: Setting up treasury data structures

Week 8: Cash and Liquidity Management

a).Managing cash flows and liquidity in SAP TRM

b).Configuring cash management settings and reports

c).Implementing forecasting and planning for cash positions

d).Hands-on exercise: Analyzing cash flows using TRM tools

Week 9: Risk Management and Compliance

a).Overview of risk management concepts in TRM

b).Implementing hedging and risk mitigation strategies

c).Compliance reporting and regulatory requirements

d).Hands-on exercise: Managing financial risks using SAP TRM

Part 4: S/4HANA Finance Integration

Week 10: Introduction to S/4HANA Finance

a).Overview of S/4HANA Finance architecture and innovations

b).Key differences between traditional SAP ERP and S/4HANA Finance

c).Integration of FI, CO, BPC, and TRM within S/4HANA

d).Hands-on exercise: Navigating the S/4HANA Finance environment

Week 11: Advanced Topics in S/4HANA Finance

a).Understanding real-time financial analytics and reporting

b).Implementing new functionalities in S/4HANA Finance

c).Exploring Fiori apps for finance and treasury processes

d).Hands-on exercise: Using Fiori for financial reporting

Part 5: Capstone Project and Best Practices

Week 12: Capstone Project Execution

a).Overview of capstone project objectives

b).Participants will design and implement a comprehensive financial solution using FICO, BPC, and TRM within S/4HANA

c).Presentation of projects and peer reviews

d).Discussion on challenges faced and lessons learned

Recommended Resources:

a).Textbooks:

a."SAP S/4HANA Finance: The Reference Guide to What’s New" by Ruth Stein

b."SAP BPC: Business Planning and Consolidation" by John S. McKinney

c."SAP Treasury and Risk Management" by Paul J. D. and others

b).Online Resources:

a. SAP Learning Hub for online training modules

b. SAP Community for discussions and knowledge sharing

c).Tools:

a. SAP S/4HANA system for hands-on practice

Assessment:

a) Weekly quizzes and assignments

b) Mid-term project focused on specific finance functionalities

c) Final capstone project showcasing a complete SAP finance solution

The SAP Finance and SAP TRM Certification ensures you know planning, production and measurement techniques needed to stand out from the competition.

The Treasury and Risk Management module from SAP (SAP FSCM-TRM) enables you to automate the processes of your. Treasury and Working Capital Management. Cash Management. Analyze, Control, Comply. Secure Financial Risk.

From a Treasury perspective, Risk Management is the practice of planning for unexpected expenditures. It is primarily about mitigating and avoiding the impact of the changing financial environment on the company's cash flow objectives. Risk management is a broad term, though.

SAP TRM is a module within the SAP system Financial Supply Chain management. SAP TRM is targeted at facilitating all Treasury and Risk related processes, such as: Optimize Working Capital. Reduce operational risk.

The Treasury and Risk Management module from SAP (SAP FSCM-TRM) enables you to automate the processes of your. Treasury and Working Capital Management. Cash Management. Analyze, Control, Comply. Secure Financial Risk.

Uplatz online training guarantees the participants to successfully go through the SAP Finance and SAP TRMcertification provided by Uplatz. Uplatz provides appropriate teaching and expertise training to equip the participants for implementing the learnt concepts in an organization.

Course Completion Certificate will be awarded by Uplatz upon successful completion of the SAP Finance and SAP TRMonline course.

The SAP Finance and SAP TRM draws an average salary of $98.952 per year depending on their knowledge and hands-on experience. The SAP Finance and SAP TRM Admin job roles are in high demand and make a rewarding career.

It is even better if you are from an accounts or finance background. SAP is the leading ERP worldwide and its popularity and demand are increasing day by day. It offers you a huge number of career options within its domain.

You can become System Specialist, Quality Engineer, Functional Consultant, Application Consultant, Advisory Consultant, Manager, Software Engineer or SAP PP QM Consultant, after clearing this module.

Note that salaries are generally higher at large companies rather than small ones. Your salary will also differ based on the market you work in.

1) SAP Finance/embedded Finance.

2) SAP FinanceConsultant.

3) FinanceAssociate Consultant.

Q1. List the key elements of SAP S/4HANA Finance.

Ans-The following are the vital aspects of SAP S/4HANA Finance:

a).Financial Planning and Analysis – With SAP Finance, companies can forecast, price range, and layout as an ongoing approach. With the benefit of predictive Analysis, groups can forecast to have an effect on commercial enterprise decisions on their organization’s economic reports.

b).Finance and Accounting – With the benefits of Advanced Accounting and Finance features, corporations can meet criminal terms. Further, they can finish the reviews of Finance on time.

c).Financial Risk Management – With the advantage of Predictive Evaluation, organizations can determine the existing risks in the processes of Finance at the initial stage and take action to correct them. It is easy to determine the exceptional feasible funding costs related to the market standards.

d).Compliance and Risk Management – With the robust economic approach, it is easy to keep away from unapproved get right of the entry to important facts in the enterprise. It is easy to perceive abuse as properly as a fraud. The corporations can be in a position to minimize the risk issue in whole financial processes.

Q2. What is the Posting Period?

Ans-The posting duration variant controls which posting periods, both regular and special, are open for every organization code. It is viable to have a one of a kind posting duration variant for each enterprise code in the organization. The posting length is independent of the fiscal year variant.

Q3. State the ways of Migration from SAP to Simple Finance?

Ans-Few ways that how corporations can move from SAP traditional FICO module to Simple Finance (that is SFIN 2.0). The ones that are new GL are capable of moving directly to Simple Finance. Those who are on usual GL intend to migrate to New GL first and then migrate to Simple Finance. This sort of migration happens only with SPRO and doesn’t need technical aid.

Q4.In SAP Simple Finance, even in case the client never uses the Asset Accounting, Is it compulsory to have a new Asset Accounting?

Ans-In Asset Accounting, in case there is no data that refers to both customizing and transactional facts that have to be moved, in such a scenario there is no required for doing the migration steps in Asset Accounting. If the consumer chose to use the Asset Accounting in their new Asset Accounting later, then they can set up the personalizing in the IMG.

Q5. What is Modeling Studio?

Ans-There are several tasks a modeling studio performs in SAP S/4Hana Finance. A few of them are protected in the following: Handle Data Services in order to enter the records from the SAP Business Warehouse States, which tables are placed in HANA, the preliminary thing is to receive metadata and then software data duplication tasks, Utilize Data services for modeling, Manage ERP requests connection Perform modeling.

Q6. What is the distinction between Logistics and Transport?

Ans-The following table gives the difference between Logistics and Transport:

Q7.Is it viable for a company to have an excellent quality money float nevertheless additionally remain in serious monetary difficulty?

Ans-Yes, it is. An organization that is selling off stock but delaying payables will show beneficial money float for some time even although they are in trouble. An additional instance would be where an employer has robust revenues for the length but future projections reveal that revenues will decrease. This would manifest when a business enterprise hasn’t focused on ensuring there have been new prospects/sales in the pipeline.

Q8.How is Account type related to File type?

Ans-We can differentiate the document type with a 2-character code like DG and more however an account type is designated by a single character code like D and so on. Defining which debts a unique file can be posted to. The frequent account types include:

a) A Assets

b) D Customer (Debtor)

c) K Vendor (Creditor)

d) M Materials

e) S GL

Q9. Is it possible to exchange an existing B/S, GL A/C to the P/L type?

Ans-Technically, you will be in a position to exchange all the fields, without the account number, of a G/L account in the Chart of Accounts area. Nonetheless, on this specific event when you Change the B/S to P&L in the GL account type then can be sure that it is stable to carry the application forward by saving the changes which will help the system to correct the suitability for the account balances.

Q10. What are the various available compression techniques?

Ans-There are three sorts of accessible compression techniques namely:

a) Cluster Encoding

b) Run-length Encoding

c) Dictionary Inscribing

Q11. What is Document type?

Ans-SAP comes delivered with a number of document types, which are used in numerous posts. The record type assists to classify an accounting transaction within the system and is utilized to handle the complete transaction and identify the account types a precise document type can submit to.

As an example, the file type AB allows you to submit to all the accounts, whereas type DZ allows you to submit only the customer payments. Every report type is assigned a number range. The common file types consist of:

a) AA — Asset posting

b) KG — Vendor credit score memo

c) AB —Accounting document

d) KN — Net vendors

e) AF — Depreciation postings

f) KR — Vendor invoice

g) DG — Customer credit score memo

h) KZ — Vendor payment

i) DR — Customer invoice

j) KG — Vendor deposit memo

k) DZ — Customer payment

l) SA — GL account document

m) X1 — Recurring entry doc.

n) X2 —Sample document

Q12.What are the essential grant chain challenges that organizations face?

Ans-The five big challenges that organizations face these days are:

a).Ignoring the ongoing growth of e-commerce as a channel in the industrial zone.

b).No attention to the practicable risk like risky transport costs.

c).Over expectation that furnishes chain administration technologies will fix everything, over-reliance on past performance to anticipate future sales.

d).Boost complexity delivered to equip chain operations with the implementation of pointless applied sciences.

e).Lack of understanding of the complete abilities of suppliers and service.

Q13. What is the SAP FI Organizational Structure?

Ans-In this image, SAP FI Organisational Structure is mentioned. With the help of this image, aspirants can easily understand.

Q14.How is it viable for the employer to show excellent quality net earnings and declare bankruptcy?

Ans-Two instances consist of deterioration of working capital (i.e. growing accounts receivable and lowering bills payable), and monetary shenanigans.

Q15.What is deferred tax liability and its purpose?

Ans-Deferred tax liability is merely contrary to a deferred tax asset. The deferred tax liability happens when a tax price claimed on the earnings statement is not paid to the IRS in the course of the same length it is recognized, it’s paid at a future date.

When there are differences in depreciation price between ebook reporting and IRS reporting, deferred tax liabilities can end up resulting in invariants of profits as reflected on a company’s earnings assertion versus what’s recommended to the IRS and which results in lower taxes payable to the IRS (in the quick run).

Q1) What are the various SAP solution grouped under SAP Treasury?

Ans-Following SAP solution are included in SAP Treasury

a) SAP Cash and Liquidity Management

b) SAP In-House Cash Management

c) SAP Treasury and Risk Management

d) SAP Bank Communication Management

Q2) What is the role of risk management system in SAP treasury?

Ans-There is a comprehensive risk management system present in SAP Treasury which analyzes and measure the amount of risks and classify according to requirements of the organization.

Q3).What are the various components of SAP Treasury?

Ans-Various components of SAP Treasury are:

a) Business partner

b) Basic functions

c) Credit Risk analyzer

d) Market risk analyzer

e) Transaction manger

f) Portfolio Analyzer (FIN-FSCM-TRM-PA)

Q4).What is the role of SAP Treasury Consultant?

Ans-

a).SAP Treasury Consultant needs to identifiy the treasury strategy customers and their functional requirements

b).Translate the functional requirements of the customer into (new) SAP processes

c).SAP Treasury Consultant also needs to implement the functionality and configure the system

d).Provide guidance and training to the key users.

Q5).Can you please explain why authorization check in Treasury is missing for authenticated user?

Ans-SAP Treasury does not have the authorization to check an authenticated user's authorization to access some of their functions as this may cause some undesired system behavior.