SAP S/4HANA Finance

Learn about SAP Simple Finance, General Ledger and Cost Elements, Integrated Business Planning Finance, Cash Management & much more. View Course Curriculum

Price Match Guarantee

Full Lifetime Access

Access on any Device

Technical Support

Secure Checkout

Course Completion Certificate

View Course Curriculum

Price Match Guarantee

Full Lifetime Access

Access on any Device

Technical Support

Secure Checkout

Course Completion Certificate

87% Started a new career

BUY THIS COURSE (GBP 29)

87% Started a new career

BUY THIS COURSE (GBP 29)

-

91% Got a pay increase and promotion

91% Got a pay increase and promotion

Students also bought -

-

- SAP SD (Sales and Distribution)

- 25 Hours

- GBP 29

- 195 Learners

-

- Bundle Combo - SAP Finance (FICO and S/4HANA Finance)

- 50 Hours

- GBP 22

- 242 Learners

-

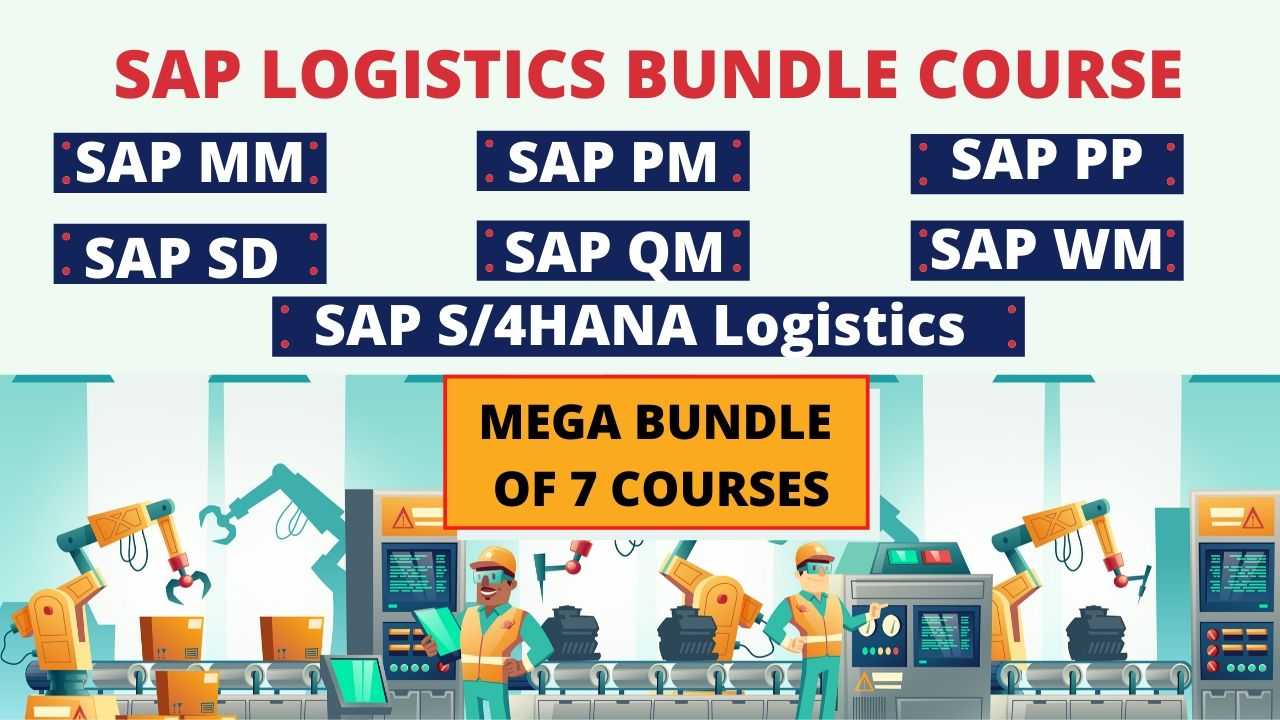

- Bundle Course - SAP Logistics (PM - PP - MM - QM - WM - SD - S4HANA Logistics)

- 200 Hours

- GBP 22

- 1692 Learners

SAP S/4HANA Finance is a comprehensive set of financial management and accounting solutions, covering financial planning and analysis, accounting and financial close, treasury and financial risk management, collaborative finance operations, and enterprise risk and compliance management powered by the SAP HANA in-memory database.

SAP S/4HANA Finance is the financial management solution within the SAP S/4HANA ERP suite. It provides real-time financial insights, integrates financial processes, and enhances reporting and analytics capabilities.

SAP S/4HANA is the next generation business suite from SAP fully integrated with most advanced in-memory platform, SAP HANA. Using SAP S/4HANA Finance, user can create a common view of all financial and operational data and deliver a flexible as well as easily consumable reporting. A customer can automate processes and instantly evaluate the financial implications of business options with real-time analytics, prediction, and simulation.

SAP S4HANA Finance is designed to drive business innovation with simplicity by connecting people, devices, and business networks in real time to support the development of new business models.

Key Features of SAP S/4HANA Finance

1. Universal Journal (ACDOCA)

a) Combines General Ledger (GL), Asset Accounting (AA), Controlling (CO), and Material Ledger (ML) into a single table.

b) Eliminates data redundancy and provides a single source of truth for financial data.

c) Enables real-time reconciliation across financial and management accounting.

2. Real-Time Financial Close & Reporting

a) Faster financial close through real-time consolidation and soft close capabilities.

b) Embedded SAP Fiori apps for intuitive financial dashboards and analytics.

c) Supports drill-down analysis from summary reports to transaction-level details.

3. Profitability Analysis (CO-PA) in the Universal Journal

a) CO-PA is integrated into the Universal Journal, reducing the need for cost object reconciliation.

b) Real-time margin analysis with predictive insights and AI-driven recommendations.

4. New Asset Accounting

a) Simplified depreciation calculation with real-time postings.

b) No need for periodic batch jobs; all transactions update financials instantly.

c) Parallel valuation and multiple ledgers supported for compliance with IFRS, GAAP, and local regulations.

5. Central Finance (CFIN)

a) Allows organizations to replicate financial transactions from multiple ERP systems into a single S/4HANA Finance instance.

b) Useful for companies with heterogeneous IT landscapes to achieve harmonized reporting.

6. Predictive Accounting & AI-Based Forecasting

a) Uses AI/ML to predict future revenue, costs, and cash flow.

b) Supports proactive financial planning and risk management.

7. Embedded Treasury & Cash Management

a) Provides a real-time view of cash positions and liquidity planning.

b) Includes hedging, risk management, and payment processing capabilities.

8. New Credit Management (FSCM)

a) Integrated credit risk assessment with real-time credit limit checks.

b) Uses external credit agency data for enhanced risk evaluation.

9. Simplified Tax Compliance & Regulatory Reporting

a) Supports multi-country tax calculations with embedded SAP Tax Compliance.

b) Real-time VAT/GST reporting to comply with global tax regulations.

10. Enhanced Integration with Other SAP Modules

a) Seamless integration with SAP S/4HANA Logistics, Sales, and Procurement for real-time financial tracking.

b) Connectivity with SAP Analytics Cloud (SAC) for advanced data visualization.

Course/Topic - SAP S/4HANA Finance - all lectures

-

In this first video on the SAP S/4HANA Finance course, you will be getting a detailed explanation of the Costing-based CO-PA and Account-based PA along with the derivative of characteristics which will be shown in the SAP system by the trainer. Furthermore, you will be learning about the COGS G/L Accounts.

-

In this video, you will get a brief introduction to S/4HANA Finance module, starting with the release versions of S/4HANA, its advantages, the database, and table structure, the use of Fiori in S/4HANA which will be shown in the SAP system, and the transition scenarios to S4.

-

In this session, you will learn about the idea and concept of Universal Journal along with the differences between BSEG and ACDOCA. Furthermore, you will learn about the Non-Disruptive approach, the purpose and advantages of Extension Ledger, merging of GL & Cost element master data, the currency configuration, and the steps involved in the configuration of CO Integration.

-

In this video, you will learn all the configuration settings involved with GL account in S/4HANA Finance which will be shown in a step-by-step process by the trainer in the SAP system.

-

This is a continuation video to the previous lecture where you will get some more in-depth and detailed concepts associated with the GL accounts in the S/4HANA Simple Finance module.

-

In this video, you will learn about the complete work process of Ledger for the HANA Simple Finance module and its step-by-step process in the SAP system.

-

In this video, the trainer will be going through the different apps associated with the General Ledger Accounting, and along with this, the session will also be moving further with the concepts on BP.

-

In this video, you will be going through the work process of Cash Journal Entry and Master Data Maintenance in the SAP system. Furthermore, you will be learning about the BP groupings in the S/4HANA Finance module.

-

In this session, you will learn about the concepts related to Bank Accounting Management or commonly abbreviated as BAM. During this session, you will be learning about the Bank Hierarchy, Overdraft Limits, BCM, Centralized BAM, Liquidity Management, and Cash Operations.

-

In this video, you will get a brief overview of the architecture of New Asset Accounting, the pre-requisites for New Asset Accounting, Migration, Legacy Data Transfer, the limitations associated with Asset Accounting, and others.

-

In this video, you will learn about the changes associated with Asset Accounting from a user along with the concept of Depreciation Run in the S/4HANA Finance module.

-

In this video, you will learn about the different configuration steps associated with the Migration process of the S/4HANA Finance module. The trainer will be showing a step-by-step process of the whole work procedure in the SAP system.

-

In this video, you will know and learn about the different prerequisites for the New Asset Accounting and working on the same in the SAP system.

-

In this video, you will be going through the taxation part of the SAP S/4HANA Finance module and its work process in the SAP system.

-

In this video, the trainer will be seen answering some of the queries associated with the S/4HANA Finance course along with explaining the solutions in regard to resolving the queries.

-

In this video, you will get a brief knowledge on Profitability Analysis starting with an overview on Costing-based CO-PA, Account-based CO-PA, the Profitability Analysis in the Universal Journal, COGS concept and other detailed concepts associated with it.

-

In this last video on the SAP S/4HANA Finance course, you will learn about the different steps associated with Migration in S/4HANA Simple Finance such as Migration of Customizing, Data Migration, and Activities after Migration and all these steps will be shown with a detailed explanation by the trainer in the SAP system.

• This course provides an overview of SAP S/4HANA for learners who do not yet have specific SAP background knowledge and want to build SAP S/4HANA skills

• Learn and understand all the necessary end-to-end implementation steps to configure SAP S/4HANA Finance and Controlling 1909 with End-User processes for any organization.

• After this course, the students will be able to identify and analyze the business requirements of any organization for Record to Report process cycle and to configure SAP S4 HANA FICO accordingly.

• Learn to work both as a Consultant and End-User and can also take SAP S/4HANA Finance 1909 certification exam i.e., C_TS4FI_1909.

• Explain the architecture of the SAP S/4HANA Financials component.

• Configure and use new functionalities in SAP S/4HANA.

• Use the standard SAP Fiori applications designed for SAP S/4HANA.

• Explain the SAP Central Finance deployment option of SAP S/4HANA Finance.

SAP S/4HANA FINANCE 1809

1. What is SAP S4 HANA Simple Finance

a) Introduction to SAP HANA

b) Introduction to SAP S/4HANA

c) Outlining SAP Simple Finance and SAP S/4 HANA Finance

2. Overview of SAP S4 HANA Simple Finance Add-On

a) Providing Technical Overview of the Implementation Prerequisites

b) Describe the Architecture of the Simple Finance

c) Analyzing the universal Journal in SAP

d) Analyzing SAP Central Finance

e) Providing an overview of Reporting Options

f) Introduction to SAP Fiori

g) SAP Simple Finance – Central Finance

3. Migration to SAP S4HANA Finance On-Premise Edition

a) Explaining the Migration Process for the SAP S4 HANA Finance On-Premise Edition

b) Analyzing the Migration process per system starting point

c) Simulation: Display financials tables before migration

d) Preparing for Migration to and installing the SAP S4 HANA Finance On-Premise Edition

e) Simulation: Perform System checks before migrations

f) Configuring SAP General ledger Accounting

g) Simulation: Configure General Ledger accounting for Migration in SAP

h) Configuring New Asset Accounting in SAP

i) Simulation: Configure Asset Accounting (new) for migration

j) Migration to New Asset Accounting in SAP

k) Simulation: Activate new Asset Accounting

l) Customizing Controlling (Accounting Based CO-PA)

m) Simulation: Configure Controlling for Migration

n) Migration to the Universal Journal

o) Simulation: Perform checks and data enrichment

p) Finalizing the Migration

q) Simulation: Perform and Finalize the migration

r) Simulation: Perform activities after migration

s) Simulation: Execute HANA optimized reporting transactions

t) Simulation: Create an Appendix Ledger and post a journal to it

4. The result of Migration to the SAP S4HANA Finance On-Premise

a) New Asset Accounting in SAP

b) Simulation: Create an asset and post an asset acquisition

c) Simulation: Post a partial asset scrapping and simulate a depreciation run

d) Explain the Results of Migration

e) Simulation: Perform internal order settlement

f) Simulation: Configure and test Controlling Profitability Analysis (CO-PA) characteristic derivation

5. SAP S4 HANA General Ledger Accounting

a) GL Accounts and Cost Elements in SAP Accounting powered by HANA

b) Simulation: How to create a primary Cost Account

c) Simulation: Create a Secondary Cost Account

d) Simulation: How to create an asset account as a statistical cost element

e) Simulation: Create default account assignment

f) How to use the period lock transactions

g) Managing Ledgers in SAP Accounting powered by SAP HANA

h) Simulation: Post-secondary cost to Financial Accounting

i) Simulation: Create an appendix ledger and post a document to it

6. SAP S4 HANA Asset Accounting

a) Providing an Overview of new Asset Accounting Functions

b) Simulation: Create Assets

c) Posting Logic in New Asset Accounting in SAP

d) Simulation: Posting Integrated Asset Acquisitions

e) Simulation: Post partial scrapping to an asset

f) Simulation: Post partial scrapping to an asset

g) Simulation: Execute a depreciation posting run and analyzing the log

h) Simulation: Manage Depreciation Runs

i) Configuring new Asset Accounting in SAP

7. SAP S4 HANA Management Accounting

a) Understanding the new Architecture of SAP Management Accounting

b) Simulation: How to check the configuration of the integration of FI and CO in SAP

c) Explaining CO-PA and ML in SAP Simple Finance

d) Simulation: How to check the configuration of the operation Concern

e) Simulation: How to check the customizing for the Cost of Goods Sold split

f) Simulation: Post and analyze the cost of Goods Sold splitting

g) Simulation: Process purchase to invoice (Material Ledger update)

h) Outlining new period Closing Programs for SAP Management Accounting

i) Simulation: How to check the configuration for splitting price differences

j) Simulation: post Price Difference – Variance Categories of Production Order

8. SAP S4HANA Simple Finance Integration

a) Providing an overview of Cash management Functions

b) Simulation: Mange House Bank Accounts

To add some more value to your profile, this topic will help you to understand what has been changed from the Logistics point of view

• FSCM Credit Management

• FSCM Collection Management

• FSCM Dispute Management

This SAP S/4HANA Finance training course is designed to help you clear the SAP Certified Application Associate- SAP S/4HANA for Financial Accounting Associates exam.

In the SAP S/4HANA Finance course the participants learn about the financial application. In the SAP S/4HANA Finance course, the participants will learn about financial management functionalities. This seems to be an essential learning for all SAP Finance module users.

The SAP S/4HANA Finance Certification is an important benchmark in becoming a SAP Finance Accounting Associate as the exam topic covers financial closing, account payable and receivable, overview of SAP S/4HANA.

SAP S/4HANA Finance tutorial helps the participants to learn about Financial management process and thus attaining a unique SAP certification. SAP S/4 HANA Finance course offers complete information about the deployment of Sap S/4 HANA thus making the participant a skilled SAP Finance Accounting Consultant.

Uplatz online training guarantees the participants to successfully go through the SAP S/4HANA Finance module in detail. Uplatz provides expert training to equip the participants for implementing the learnt concepts in an organization.

Course Completion Certificate will be awarded by Uplatz upon the completion of the SAP S/4HANA Finance course.

The SAP S/4HANA Finance certification exam verifies that the participants possess basic knowledge and can prove their skills in the area of S/4 HANA for Finance accounting. This SAP S/4HANA Finance certification exam validates that the participant has an overall understanding about this consultant profile, and able to implement the knowledge practically in projects.

Below given are the certification details of SAP Certified Application Associate - SAP S/4 HANA for Financial Accounting Associates

· Certification Level: Associate

· Exam Name: SAP Certified Application Associate- SAP S/4 HANA for Financial Accounting Associates

· Exam Code: C_TS4FI_1909

· Exam Mode: Online

· Total Number of Questions: 80

· Pass Score: 57%

· Time Duration: 180 Minutes

· Exam fee: $550

The SAP Finance Accounting Consultant draws an average salary of $109,000 per year depending on the knowledge and hands-on experience. The SAP Finance Accounting Associates job roles are in high demand and make a rewarding career.

The SAP Finance Accounting Associates are recognized across the globe. The increased usage of the Finance management in many companies help the participants to find a job opportunity easily. The Learners earn most beneficial SAP S/4HANA Finance certification through our expert training and course curriculum. Being SAP Finance certified is definitely valuable credential and adds value to every organization.

The SAP S/4HANA Finance certification is targeted to those who are beginners, finance background and excel in finance area.

The following are the job titles:

· SAP Finance Associate

· SAP Finance Accounting Consultant

· SAP Accounting Developer

· SAP S/4HANA Finance Consultant

· Chartered Accountant

The SAP S/4HANA Finance certification program helps the participants to get placed in reputed MNCs and organizations.

1. What is SAP S/4HANA Simple Finance?

SAP S/4HANA Finance is primarily based on SAP HANA, which can be deployed in the cloud or on-premise. This is designed so that it will be convenient to use, it can deliver immediate insight for finance specialists. It enhances the existing finance solution portfolio from SAP, its purposeful strength remains the same while enabling non-disruptive migration.

2. List the key elements of SAP S/4HANA Finance.

The following are the vital aspects of SAP S/4HANA Finance:

- Financial Planning and Analysis – With SAP Finance, companies can forecast, price range, and layout as an ongoing approach. With the benefit of predictive Analysis, groups can forecast to have an effect on commercial enterprise decisions on their organization’s economic reports.

- Finance and Accounting – With the benefits of Advanced Accounting and Finance features, corporations can meet criminal terms. Further, they can finish the reviews of Finance on time.

- Financial Risk Management – With the advantage of Predictive Evaluation, organizations can determine the existing risks in the processes of Finance at the initial stage and take action to correct them. It is easy to determine the exceptional feasible funding costs related to the market standards.

- Compliance and Risk Management – With the robust economic approach, it is easy to keep away from unapproved get right of the entry to important facts in the enterprise. It is easy to perceive abuse as properly as a fraud. The corporations can be in a position to minimize the risk issue in whole financial processes.

3. What is the Posting Period?

The posting duration variant controls which posting periods, both regular and special, are open for every organization code. It is viable to have a one of a kind posting duration variant for each enterprise code in the organization. The posting length is independent of the fiscal year variant.

4. State the ways of Migration from SAP to Simple Finance?

Few ways that how corporations can move from SAP traditional FICO module to Simple Finance (that is SFIN 2.0). The ones that are new GL are capable of moving directly to Simple Finance. Those who are on usual GL intend to migrate to New GL first and then migrate to Simple Finance. This sort of migration happens only with SPRO and doesn’t need technical aid. There is a distinction when migration is from the central factor of Finance that sustains with shifting information dispensed Enterprise Resource Planning panorama and non-SAP Enterprise Resource Planning, utilizing SLT.

5. In SAP Simple Finance, even in case the client never uses the Asset Accounting, Is it compulsory to have a new Asset Accounting?

In Asset Accounting, in case there is no data that refers to both customizing and transactional facts that have to be moved, in such a scenario there is no required for doing the migration steps in Asset Accounting. If the consumer chose to use the Asset Accounting in their new Asset Accounting later, then they can set up the personalizing in the IMG.

6. What is Modeling Studio?

There are several tasks a modeling studio performs in SAP S/4Hana Finance. A few of them are protected in the following: Handle Data Services in order to enter the records from the SAP Business Warehouse States, which tables are placed in HANA, the preliminary thing is to receive metadata and then software data duplication tasks, Utilize Data services for modeling, Manage ERP requests connection Perform modeling.

7. Is it viable for a company to have an excellent quality money float nevertheless additionally remain in serious monetary difficulty?

Yes, it is. An organization that is selling off stock but delaying payables will show beneficial money float for some time even although they are in trouble. An additional instance would be where an employer has robust revenues for the length but future projections reveal that revenues will decrease. This would manifest when a business enterprise hasn’t focused on ensuring there have been new prospects/sales in the pipeline.

8. How is Account type related to File type?

We can differentiate the document type with a 2-character code like DG and more however an account type is designated by a single character code like D and so on. Defining which debts a unique file can be posted to. The frequent account types include:

- A Assets

- D Customer (Debtor)

- K Vendor (Creditor)

- M Materials

- S GL

9. Is it possible to exchange an existing B/S, GL A/C to the P/L type?

Technically, you will be in a position to exchange all the fields, without the account number, of a G/L account in the Chart of Accounts area. Nonetheless, on this specific event when you Change the B/S to P&L in the GL account type then can be sure that it is stable to carry the application forward by saving the changes which will help the system to correct the suitability for the account balances.